9 Predictions for PE in 2026, Starting with AI Rollups First

PE has always competed with other pools of capital. In 2026, it starts competing with something else: AI rollups.

More AI rollups are showing up with permanent capital and a plan to turn “boring” businesses into higher-margin machines through automation. If that prediction comes true, several other trends are likely to emerge as well.

1) AI rollups crank up competition for deals

They tend to like the same hunting grounds PE loves: fragmented markets and businesses where ops are messy enough that standardization creates real leverage. Notable examples include Thrive Holdings, Beacon Software, Equal Parts, Eudia, and Titan. There are many more out there. They have clear mandates, they move fast (we see this as some are customers of Scend), and they're changing what “a credible buyer” looks like.

- What changes: competition shifts from “who can finance” to “who can find assets and operationalize quickly”

- What you’ll notice: more buyers digging into workflow transformation, not just parroting a generic second bite of the apple

In 2025, I mainly saw VCs funding AI rollups, but I can also see search funds rebranding to AI rollups and accessing capital from family offices, amongst others, too.

2) AI implementation consultants become a standard vendor, like bankers and lenders

I'm optimistic that AI in PE shifts from strategy to deployment. Since PE bros aren't tech bros though, PE folks will start calling on them more heavily.

AI implementation consultants will be on speed dial to do the unsexy work that actually drives ROI (see below). And this starts happening during diligence, not after close, because it changes underwriting.

What they’ll get hired for:

- figuring out where AI creates new revenue opportunities

- workflow mapping (what really happens vs what the SOP claims)

- data readiness and system integration

- agent design, QA, monitoring, governance

- firmwide adoption and change management

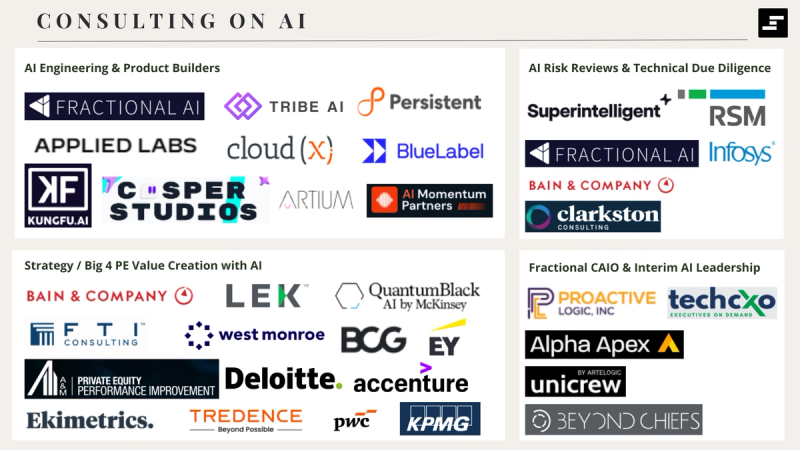

That said, not all consultants are created equal. Here's a market map of some folks to consider:

3) Hold periods creep longer

AI efficiency gains compound, but the timeline is unclear. You can automate obvious tasks quickly, but the real payoff often comes later when the company actually changes how it works. Great organic growth opportunities are hard to give away.

Also, competing with permanent capital could force a mindset shift. If a competing buyer can hold longer and keep compounding improvements, it pressures PE to either extend duration or get more creative with continuation vehicles and recaps.

4) The discovery boom collapses sourcing differentiation

With Scend, it's become so easy to map a market and say, “we have a perfect proprietary list of bankers and companies”. The database/CRM stops being a moat. Relationships don’t.

Tools like Scend easily compress:

- market mapping

- company target universes

- banker lists

- outreach lists

So the edge moves to:

- access (who picks up your call)

- credibility (do they believe you understand their business)

- speed to conviction (can you be decisive without being sloppy)

5) Headcount actually grows for certain departments

Some work gets cheaper/faster: financial models, IC memos and decks, and first-pass screens. But that does not mean firms shrink their ambition. If anything, they expand coverage and redeploy people into higher-leverage work.

Expect more hiring in:

- sourcing and relationship building

- portfolio value creation and operating resources

Expect less time spent on the deal execution side

6) Brand and trust matter more than fund size

If everyone can eventually find the same targets, founders and intermediaries choose based on trust, clarity, and track record. In 2026, more firms will act like operators with a point of view.

Leading with content means being visible before you find a deal, so when you do reach out, it doesn’t feel like a cold pitch. We wrote an article about VCs doing this and how PE should too.

What this looks like:

- clear sector POVs

- practical playbooks that actually help operators

- communities, referrals, and reputation compounding

7) Banker auctions get broader and pricier

As buyer discovery and outreach get easier, banker-led processes get wider. More PE firms will know more bankers, too. More buyers mean prices rise.

That pushes PE toward the same conclusion: you need more proprietary sourcing for alpha, and you need to do real work before the auction starts. I think all PE firms will look into in-house BD teams or expand exclusive relationships within buy-side banks/origination firms in 2026.

Expect:

- broader buyer universes

- faster processes

- more competition that feels “instant”

8) Industry diligence shifts from CYA to truth-finding

AI has crushed the cost of processing. Historically, PE firms spent hundreds of thousands, maybe millions, on Bain, BCG, McKinsey, and LEK to create bespoke research to validate an industry thesis and paste into an IC memo. It used to be extremely hard work. Now you can get sourced CYA with Scend or other AI tools for cents on the consulting dollar.

The differentiator becomes what it should have always been: investigation and interpretation. More expert calls, more pressure-testing assumptions with consultants, more reference checks, customer surveys, and less performative CYA.

9) LPs further unbundle the GP

As LPs get more sophisticated and liquidity becomes more valuable, they’re increasingly buying PE exposure à la carte:

- secondaries to actively manage liquidity and portfolio shape

- co-invest to concentrate on specific deals at lower fees

- selective re-ups based on proven differentiation

The implication for GPs:

- fundraising becomes more competitive

- co-invest becomes part of the product

- differentiation/narrative becomes a bigger focus area

Throughline

AI is making information cheap. Humans become the moat again.

Anirudh Sathya

January 6, 2026