Market Research: ABA Therapy

Table of Contents

Overview

Applied Behavior Analysis (ABA) therapy is the leading treatment for Autism Spectrum Disorder (ASD), using behavioral conditioning techniques to improve social, communication, and learning skills. ABA is widely regarded as the gold-standard intervention for autism and related developmental conditions, and nearly all U.S. insurers (private and public) now cover ABA therapy for ASD. ABA therapy does support various age groups and conditions, but it is currently interconnected with ASD because payors typically will not cover services for other conditions.

Services are delivered in a mix of settings: in-home one-on-one therapy, center-based clinics, community or school-based programs, and increasingly via telehealth for certain training or supervision tasks. Treatment is often intensive (young children can receive 20–40 hours per week of ABA), and is overseen by BCBAs with day-to-day implementation by paraprofessional technicians (Registered Behavior Technicians, or RBTs). This labor-intensive model means human capital is the critical limiting factor for growth.

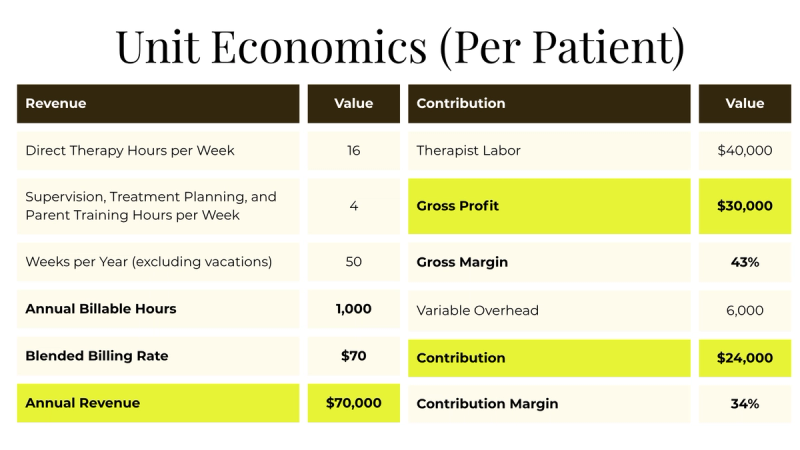

ABA therapy providers generate revenue primarily through hourly billing to commercial insurance and Medicaid, typically ranging from $50–$90 per therapy hour delivered by Registered Behavior Technicians (RBTs) under the supervision of licensed clinicians (BCBAs).

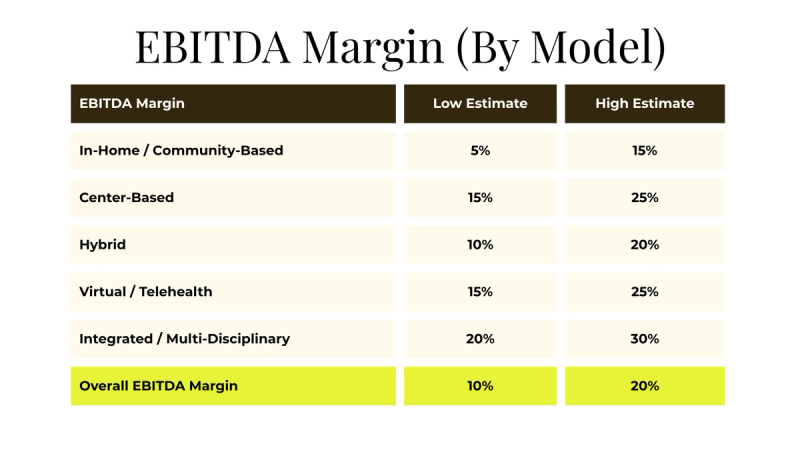

Profitability hinges on maximizing therapist utilization and maintaining favorable reimbursement rates while carefully controlling labor costs—usually 50–60% of revenue—as well as administrative overhead, compliance, and facility costs. Effective revenue cycle management, scale, and operational efficiency directly drive margins.

Business Models

1. In-Home/Community-Based: Therapists (RBTs, supervised by BCBAs) deliver one-on-one ABA services at clients' homes, school, daycare, or public settings (i.e. parks). Representative company examples:

- Centria Autism: Based in Michigan and one of the largest national ABA providers known predominantly for in-home autism therapy.

- Invo: Primarily provides in-school ABA services with a presence across numerous states.

2. Center-Based: ABA therapy provided at dedicated brick-and-mortar centers, usually in a clinical or preschool-like setting during day-time hours. Representative company examples:

- Hopebridge Autism Therapy Centers: Extensive presence in the Midwest and Southeast, operating dedicated centers.

- Action Behavior Centers (ABC): Operates a network of dedicated ABA centers, notably across Texas and surrounding states.

3. Hybrid: Combines home and center-based treatment. Representative company examples:

- BlueSprig: Offers both center-based and in-home services across multiple states, including Texas and Florida.

- Verbal Beginnings (VB): Emphasizes flexibility to accommodate family needs and optimize clinical utilization in the Mid-Atlantic region.

4. Virtual / Telehealth: Therapy delivered remotely via video conferencing or mobile apps, used for parent training, BCBA supervision, and consultation. Representative company examples:

- AnswersNow: Offers BCBA-only parent training and direct 1:1 virtual therapy sessions.

- Forta: Parent-led ABA with remote BCBA supervision. Raised $55 million in VC funding and shut down because of regulatory issues (using patients' parents as RBTs and billing insurance does not work).

5. Integrated / Multidisciplinary: Offers ABA therapy integrated with other clinical services like speech therapy, occupational therapy, diagnostics, psychological evaluations, and family support services within one entity. Representative company example:

- Cortica: Offers whole-family treatment models with value-based care contracts.

Key Revenue/Margin Drivers

- Labor utilization and efficiency: Maximizing therapist billable hours.

- Reimbursement rate negotiation: Optimizing payer contracts.

- Geographic & demographic targeting: High-income areas and states with favorable reimbursement rates and high autism prevalence.

- Operational efficiency: Strong scheduling and back-office processes.

- Scale: Higher scale generally provides negotiating power, operational leverage, and cost efficiencies.

Pricing

ABA therapy reimbursement rates average between $50–$90/hour, with notable variance by client type, payor, and service setting. Commercial insurers typically reimburse at higher rates ($65–$90/hour), whereas Medicaid rates average lower ($45–$65/hour), creating reimbursement differences of roughly 20–30%. Center-based therapy can command a 10–15% premium over in-home therapy but is not common. BCBAs are able to bill for services at a rate approximately 25-35% higher than RBTs. State-level payor differences can further impact pricing by more than 25%, directly influencing provider margins, which typically range from 45–55%, with labor representing 50–60% of revenue.

Unit Economics

This is a high-ticket industry where each patient generates a lot of revenue for the ABA company because the amount of weekly therapy hours can be quite intensive.

Total Addressable Market (TAM)

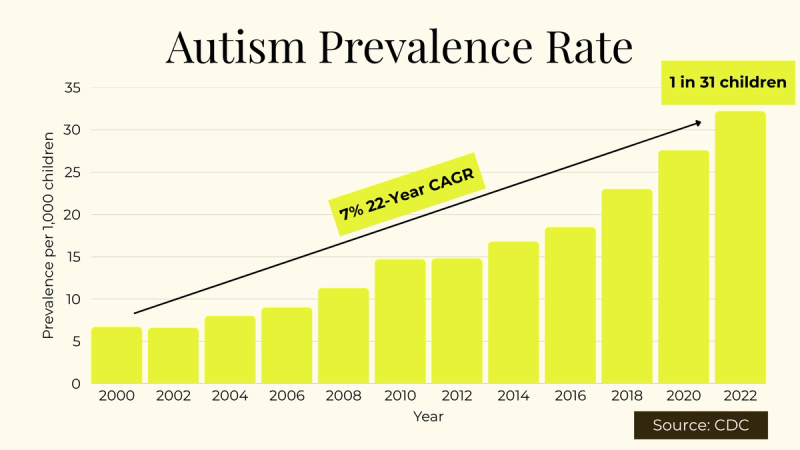

On the demand side, prevalence of autism has risen markedly – about 3.2% of U.S. children are diagnosed on the spectrum (roughly 1 in 31 as of 2022 according to the CDC) – driving substantial demand for behavioral therapeutic services. An estimated 600,000 U.S. children with autism could benefit from ABA, translating to a need on the order of $30–50 billion in annual services.

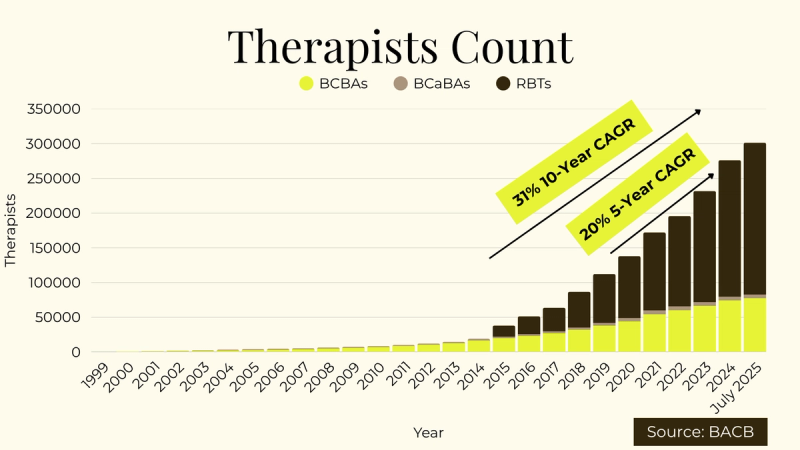

However, the supply of providers lags far behind demand. Due to provider shortages the realized market is only around $13–21 billion today. There are 77,415 Board Certified Behavior Analysts (BCBAs), 5,221 Board Certified Assistant Behavior Analysts (BCaBAs), and 218,757 Registered Behavior Technicians (RBTs). It is unknown how many unlicensed Behavior Technicians (BTs) there are but estimates suggest there equally as many licensed RBTs as there are unlicensed BTs. Given the 1:1 nature of clinical provider to patient, far too few providers are in the field to serve all diagnosed children. This supply-demand imbalance means many families still face waitlists or inadequate care access, even as the industry expands.

This large TAM is driven by rising autism prevalence and broader insurance coverage. Autism diagnoses have grown rapidly, and virtually all diagnosed children can medically benefit from early intensive behavioral intervention. The average annual cost of ABA therapy per child can range from tens of thousands up to $100k for intensive programs, so even a moderate fraction of the eligible population receiving therapy yields a multi-billion dollar market. Beyond core autism services, some providers are expanding into adjacent offerings (social skills groups, speech and occupational therapy, etc.), which could increase wallet share per client and expand the addressable market further. For example, many ABA companies now strive to be one-stop-shops for autism care, adding speech therapy, feeding therapy, or diagnostic services alongside ABA. These ancillary services broaden the revenue base.

It’s worth noting that payer funding is the ultimate governor of TAM in healthcare. The good news for ABA: all 50 states mandate private insurance to cover autism treatment (typically including ABA), and Medicaid covers ABA under federal guidance (EPSDT) for children with ASD. Over 200 million Americans have some level of ABA coverage through commercial or public insurance. Thus, the theoretical TAM can increasingly translate into effective demand as provider supply grows – unlike some sectors where lack of reimbursement constrains the market. In summary, the U.S. ABA therapy industry has a multi-billion dollar current footprint with a long runway for growth toward a much larger TAM as capacity catches up with the prevalence-driven need.

Market Growth

Historically, the prevalence of autism has increased from 1 in 150 in 2000 to 1 in 31 as of 2022. This represents a 22-year CAGR of 7% on the demand side. On the supply side, there's really promising historical growth.

As of 2024, the clinical count has increased at a 10-year CAGR of 31% overall and the past 5-year CAGR is 20% overall.

On the insurance side, funding has also been favorable historically with the 2008 Mental Health Parity Act and the 2019 2019 Autism CARES Act. Because the major growth essentially started with the 2008 Mental Health Parity Act and established insurance funding for the industry, the hyper-growth of initial market formation should not be expected going forward. Recent market research puts the expected expansion in the mid-to-high single digits. For instance, Global Market Insights estimates the U.S. ABA services market will grow at about 4.8% CAGR from 2024 to 2032. These figures likely assume a maturing industry where most regions have some service availability and payers push for cost containment. However, actual growth could outperform projections if the supply of practitioners sustains without payor spend pullback. The underlying demand drivers remain very favorable: autism diagnosis rates are increasing and children diagnosed today will often require services for many years.

Regulation

For the last 15 years, Regulatory and reimbursement frameworks in the U.S. strongly favored the ABA therapy industry. By 2019, all 50 states had adopted insurance mandates requiring commercial insurers to cover medically necessary ABA therapy, significantly expanding access and funding for autism services. Additionally, federal Medicaid guidance (via the EPSDT benefit) clarified mandatory coverage of ABA therapy nationwide, though implementation details vary across states, impacting reimbursement rates and provider margins.

There are a handful of topics in this realm investors should be aware of. First, while there are mandates for ABA benefits, oversight whether insurance plans are following through is fairly limited. An example of this is how opaque it is to define insurance network adequacy. Insurance plans can fairly arbitrarily deny new ABA providers from going in-network in certain states or altogether by saying that their network is closed because they already have enough ABA providers. There are no specific metrics so it is largely up to commercial payors to dictate which ABA providers can enter their network and get reimbursed as in-network providers. Additionally, clinicians must also navigate state-by-state licensing and credentialing requirements, primarily overseen by the Behavior Analyst Certification Board (BACB). Most states accept BACB certification but certain states, have their own definitions and coursework outlining clinician quality and practice standards. This can limit therapists from moving to and working in certain states.

On a company level, some ABA companies have sought accreditation from organizations like the Behavioral Health Center of Excellence (BHCOE), as a key marker of clinical quality, but it is currently completely optional. Compliance with federal healthcare regulations such as HIPAA, along with heightened payer scrutiny with increasing audit frequency over clinical outcomes and billing practices, further impact operational complexity. Lastly, investors must be aware of Corporate Practice of Medicine laws. As such, it is recommended that investors consider legal structures with multiple entities (minimally a Managed Service Organization and Professional Corporation). Different states have different laws around the inter-company relationships and how profits can be stored across the different entities.

Macro (Headwinds/Tailwinds)

Headwinds. Key challenges in ABA therapy include the labor shortage, resulting in high turnover, wage inflation, and operational strain. Reimbursement variability across states and payors, combined with cost pressures, creates margin risks. Additionally, rapid expansion can compromise clinical quality if staffing and infrastructure don't scale effectively, as evidenced by high-profile bankruptcies (e.g., CARD). Additionally, increased audit scrutiny around clinical outcomes and public perception demands ongoing investments in quality assurance and compliance. Finally, select states have already reduced Medicaid rates (like Indiana) could be a signal that other states may follow.

Tailwinds. Strong demand and supply tailwinds support continued growth: increasing autism prevalence and awareness are driving steady demand while there have been very significant gains to certified providers. Many new college programs are minting new BCBAs and RBTs in an accelerated pace. The demonstrated clinical efficacy of ABA therapy underpins insurer and parental adoption as well. Expanded service models like telehealth and integrated multidisciplinary care improve accessibility and revenue diversification. Moreover, active private equity investment continues fueling industry consolidation, professionalization, and scalable growth.

Potential Trends

- Widespread adoption of technology platforms (telehealth for virtual RBT supervision and parent training, or AI-powered session note generation) enhancing operational efficiency

- Holistic, multidisciplinary care models serving broader age ranges and client needs

- As of now, payors are talking about it but are not really implementing value-based reimbursement tied to measurable clinical outcomes. A big issue is that patients need therapy for several years but patients actually change insurance plans every 3-4 years. As a result, payors who would make early investments in their members' health outcomes would see those benefits generally accrue to other payors, not themselves.

- Industry consolidation continues to build large regional/national platforms.

Technology Suppliers

Here are the top 3 technology categories that ABA therapy companies invest in significantly, along with leading providers in each category:

1. Practice Management, Data Collection, and Billing Software. These tools streamline scheduling, insurance billing, electronic health records (EHR), client management, and compliance documentation. They're critical to efficiently managing ABA practices. Top providers:

- CentralReach: ~70% market share and widely used by large, multi-location ABA therapy providers.

- Rethink Behavioral Health: Combines clinical data collection, progress monitoring, and treatment plan management and somewhat popular with medium-sized ABA providers.

2. Revenue Cycle Management Platforms. These platforms can help ABA companies outsource the work of maximizing collection rate. Top provider:

- Camber: Series B provider of AI-supported billers and collection (RCM).

3. Clinical Operations Augmentation. These AI-powered platforms can help ABA companies supercharge a few of the many manual tasks needed to get ABA companies authorized for services and compliant with payors. Top providers:

- Silna Health: Series A company providing AI-powered authorization and eligibility/benefits verification.

- Brellium: Series A company providing AI-powered session note auditing.

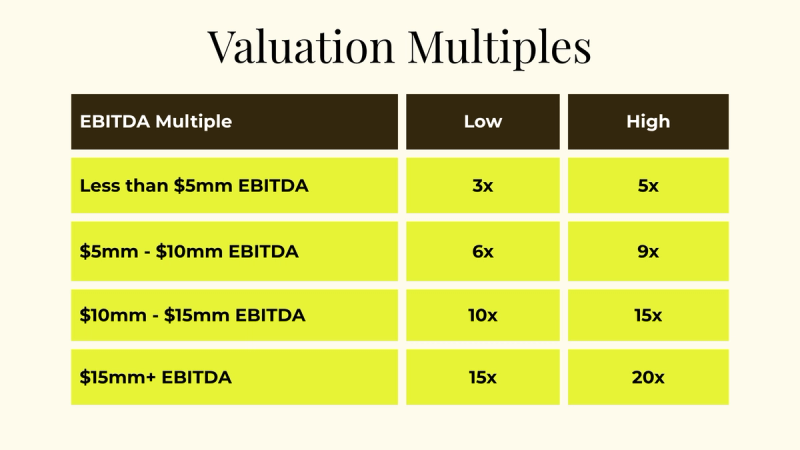

Multiple / Valuation Expectations

As always, valuation multiples are strongly dependent on various factors like a company's margin profile, growth rate, track record of M&A, capital efficiency, strength of the management team, and macro-economic factors like interest rates, but here's our view on the industry's multiples based on scale:

Largest Companies

- BlueSprig Pediatrics: ~170 centers across multiple states; backed by KKR.

- Centria Autism: National scale, strong in-home therapy model; backed by Thomas H. Lee Partners.

- Autism Learning Partners (ALP): Extensive West Coast presence; owned by FFL Partners.

- Action Behavior Centers (ABC): Texas-based center model; owned by Charlesbank Capital.

- ACES Autism: Strong West Coast presence; acquired by General Atlantic.

- Proud Moments ABA: 70+ centers across East Coast; recently acquired by Nautic Partners.

- Hopebridge Autism Centers: Midwest/Southeast; owned by Arsenal Capital.

- Behavioral Innovations: 77 centers across Texas and nearby states; owned by Tenex Capital.

- LEARN Behavioral: Multi-state, school-focused provider; owned by Gryphon Investors.

- Lighthouse Autism Center: Midwest presence; owned by Cerber

Consolidation

The ABA therapy market remains highly fragmented but is rapidly consolidating, driven primarily by private equity activity. The top 10 companies represent only about 10–15% of total market share (STAX), underscoring significant opportunities for continued consolidation. Over 40 PE-backed platforms have emerged since 2017, including notable secondary buyouts such as Proud Moments, indicating the industry is maturing – early entrants are exiting and new investors (including some large-cap PE funds) are coming in. In fact, between 2017 and 2022, 85% of all mergers and acquisitions in autism services were by PE firms (either new platform creations or add-on acquisitions), a proportion unparalleled in other healthcare segments (PESP).

Despite all this consolidation activity, the industry remains hyper-fragmented at the tail end. There are thousands of small providers that have not (yet) been acquired. Even with dozens of PE-backed groups rolling up add-ons, the long tail of mom-and-pop operations means true consolidation (where a few big players dominate) is still a ways off. The space is not like dialysis or lab testing, for instance, where a few companies control a majority of the market. Here, each major metro might have 10+ different ABA providers, and new startups continue to form given low barriers to entry (a BCBA with an entrepreneurial bent can start their own practice fairly easily).

Precedent Transactions

After 24 months of low M&A activity, there have been several deals in the past 12 months. Below is a list of past M&A deals:

Relevant Bankers

- Calex Partners: 10+ ABA deals including Proud Moments ABA (sold to Nautic Partners)

- Mertz Taggart: Sold MPG to ARC Health and has frequent ABA whitepapers

- The Braff Group: 5+ ABA deals including deals to Learn Behavioral, Stepping Stones Group, and Invo

- Provident Healthcare Partners: Handful of ABA deals and whitepapers on the industry

- Agenda Health: Recently worked on the Commonwealth ABA sale to Already Autism

- Brentwood Capital: Exclusively focused on middle market healthcare deals actively focused on behavioral health

- Cain Brothers: One of the strongest middle market healthcare banks

- Harris Williams: One of the strongest middle market banks that will ensure a broad set of investors

Conferences

Acquisition Targets

If you're interested in the most comprehensive list of companies in this space or market maps in other industries, then please log into our platform or book a demo below!

Anirudh Sathya

July 31, 2025