How Complete is Your Deal Sourcing "Waterfall"?

When investment bankers identify companies to market, private equity professionals scout platform investments or tuck-ins, and management consultants map industries, completeness isn't optional—it's part of the job.

Quality target lists drive more successful deals. To ensure you're not missing opportunities, our research shows that more than one data set is necessary.

Why Completeness Matters:

You may work for a firm that allows you to 80/20 the problem and just pick one. Our data says that isn't enough. Each resource has different data sets: Pitchbook has 5 million companies, while LinkedIn has 67 million companies. Then there's Google, which has companies that LinkedIn doesn't have.

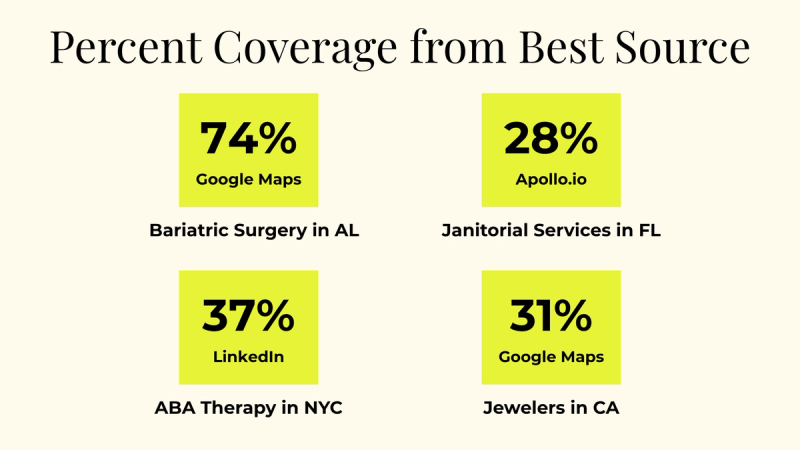

Below are a few examples with varying top-performing resources from our waterfall:

Here’s a list of great options for your own waterfall approach:

Core Sourcing Options:

- Company Databases:

- Crunchbase, Harmonic, and Grata: Startups and middle-market companies

- Pitchbook and CapitalIQ: Established companies

- People-Focused Directories:

- LinkedIn: 67 million company profiles are indispensable for so many industries

- Apollo and Zoominfo: Key contact info and organizational structure

- Geospatial and Local Sources:

- Google Maps: Ideal for finding businesses with physical locations and not on LinkedIn (e.g., healthcare, retail, manufacturing)

- Yelp and Foursquare: Brick-and-mortar data sets

- Sector-Specific Vertical Tools:

- Healthgrades/ZocDoc: Clinical organizations

- Zillow, Avvo, Clutch, Angie, Cars.com, etc.: Detailed for their respective verticals

- Trade association/conference directories: Industrial sectors

- Real-Time Queries:

- LLMs: Ask them to do deep research on a specific industry

- Expert blog posts: Frequently identify top competitors in a market

Are There Diminishing Returns?

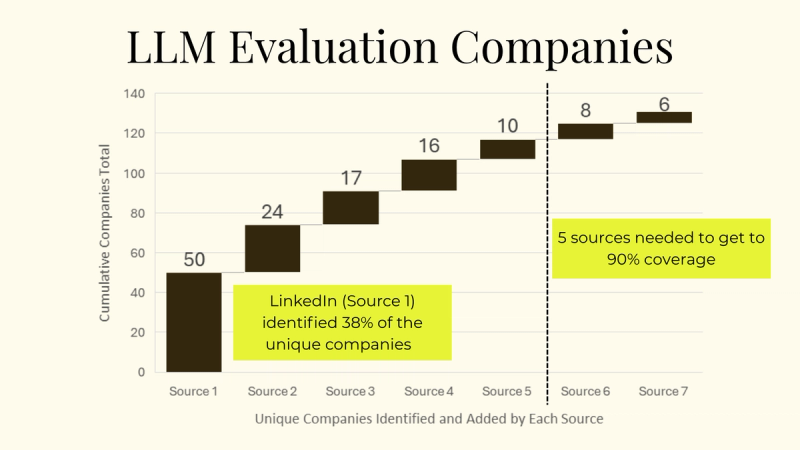

Fortunately, yes. We found that it takes at least 5 sources before you see a meaningful drop-off in new relevant companies being identified and added to the pipeline.

Here's a more detailed breakdown of our waterfall in another industry:

We thought the bar would be lower, but there's another wrinkle we learned about: different querying methods. Pitchbook uses keyword-based searching while LinkedIn uses semantic search methods. Google Maps searches can be heavily restricted by geographic parameters. ChatGPT, Perplexity, and Gemini are probabilistic and black boxes for how deeply they search. This means you'll get different results even if they had the same list of companies, business descriptions, and other firmographics, which they don't.

The Bottom Line:

If your deal sourcing waterfall is incomplete, chances are your pipeline is, too.

You may think that querying LinkedIn for a comprehensive list of companies will solve all your problems — I certainly did. But lots of testing proved that's not the case. We had to build a much bigger waterfall, aggregating several different partnerships to build comprehensive origination lists. We built Scend to unify great data sources.

If you care about ensuring your deal sourcing pipeline is complete but don't want to do it yourself, please reach out!

Stick Around for More!

If your next question was how to best prioritize high-coverage target lists to get high accuracy as well, we'll help you trade in your shotgun for a sniper rifle. More data on that to come soon!

Anirudh Sathya

June 20, 2025